Your credit score is determined by a proprietary mathematical formula. It is weighted by several different factors which include your payment history, amounts owed, age of credit history, recent loans, and the types of credit you have. There are many different versions of credit scores. The most commonly referenced is the FICO credit score, which is considered the industry standard.

FICO Credit Score Ranges:

- FICO Credit Score Range: 300 - 850

- Good Credit Score: above 700

- Average Credit Score: 680 - 700 (depending on source)

- Poor Credit Score: Below 620

FICO Score Depends on the Following Facts:

- Payment History: 35%

- Amounted Owed: 30%

- Length of Credit History: 15%

- New Credit: 10%

- Types of Credit Used: 10%

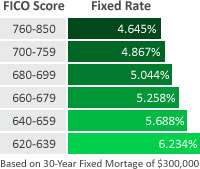

As some TV commercials want you to believe, you don't need a good credit score to drive a nice car and, and buy expensive things. A good or bad credit score doesn't guarantee you a loan, or necessarily prevent you from getting a loan. A good credit score will make it easier for you to be approved for one, and allow more credit to be available to you. It will also help qualify you for lower interest rates when you are approved. Low interest rates can make a HUGE impact over the life of a loan.

As some TV commercials want you to believe, you don't need a good credit score to drive a nice car and, and buy expensive things. A good or bad credit score doesn't guarantee you a loan, or necessarily prevent you from getting a loan. A good credit score will make it easier for you to be approved for one, and allow more credit to be available to you. It will also help qualify you for lower interest rates when you are approved. Low interest rates can make a HUGE impact over the life of a loan.

Loans are obtainable, even with a poor credit score. However, the terms, and size of the loan will vary widely. The difference will come in the form of a required down payment, or in the interest rate you will have to pay.

Let's look at some examples of how good and poor credit scores will affect your payment structure on a mortgage, and an auto loan. There is a substantial difference in monthly payments between high and poor credit scores, and the payments over the life of the loan should be enough to convince you that a good credit score is valuable!

Effect on Fixed Mortage Based on Credit Score

Effect on Auto Loan Based on Credit Score

Call 800.367.9920 today for a free consultation or fill out our form to find out if you qualify for a debt reduction program!